Insurer's Facebook analysis plans blocked

Insurer's Facebook analysis plans blocked

An insurer's plan to analyse the personalities of first-time drivers by checking their Facebook profiles has been blocked.

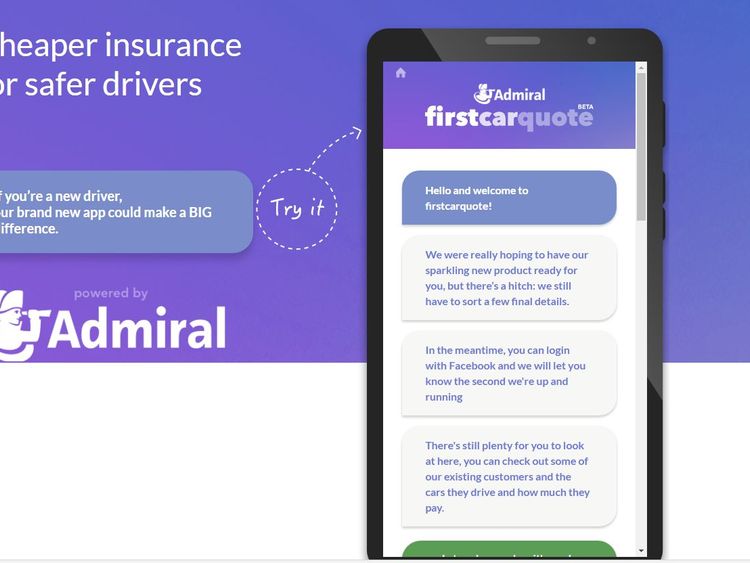

Announcing its firstcarquote scheme, Admiral said it would use an algorithm to examine social media pages to determine whether prospective customers would be careful drivers.

The firm claimed that those who opted-in could receive a discount of up to 15%.

However, Facebook has said it would be against its guidelines to allow Admiral to offer customers reduced quotes in return for access to their profiles.

Admiral has subsequently postponed the scheduled launch of its firstcarquote app.

A spokesperson for Facebook said: "We have made sure anyone using this app is protected by our guidelines and that no Facebook user data is used to assess their eligibility.

Facebook's login page

Image Caption:

Facebook says the scheme contravenes its policies

"Facebook accounts will only be used for login and verification purposes.

"Our understanding is that Admiral will then ask users who sign up to answer questions which will be used to assess their eligibility."

In a message on its website, Admiral said: "We were really hoping to have our sparkling new product ready for you, but there's a hitch: we still have to sort a few final details."

A spokeswoman for the insurer said the initiative would still go ahead, but in a reduced format.

She said: "Following discussions with Facebook the product is launching with reduced functionality, allowing first-time drivers to login using Facebook and share some information to secure a faster, simpler and discounted quote."

Earlier, Admiral claimed it would only consider a "snapshot" of a customer's Facebook profile while it calculated a quote.

Admiral has pulled the scheduled launch of its firstcarquote app

Image Caption:

Admiral has pulled the launch of its firstcarquote app

The firm added: "We want to help make sure safe drivers aren't penalised and get the best price possible.

"To do this, we'll look at your Facebook profile to help us get a better understanding of the type of driver you are."

Writing style and the use of calendars or accounting apps would have been considered in the analysis, The Times reported.

Renate Samson, the chief executive of Big Brother Watch, described the scheme as "terrifying".

Meanwhile, shadow minister for the digital economy, Louise Haigh, said the Government needs to establish the boundaries around the use of data on social media.

Ms Haigh said: "We need to get ahead of the game."

According to an index from the AA, young drivers aged 17 to 22 face paying an average of £1,286.96 for an annual policy.

![The Three Musketeers Part II Milady (2023) [French]](https://www.memesng.com/r/storage.waploaded.com/images/42c002982f33f5e0a77f2999423ce805.jpg?w=50&ulb=true&ssl=1)

![The Midnight Studio (2024) [Korean] (TV series)](https://www.memesng.com/r/storage.waploaded.com/images/d6f04a4da0205815037af7bc42c2da7c.jpg?w=50&ulb=true&ssl=1)

![Sword and Fairy 1 (2024) [Chinese] (TV series)](https://www.memesng.com/r/storage.waploaded.com/images/674302e9e9b6ff353fc11d3dd380c03f.jpg?w=50&ulb=true&ssl=1)

![Blossoms in Adversity (2024) [Chinese] (TV series)](https://www.memesng.com/r/storage.waploaded.com/images/61dc1dfa16c766d022b3d5ff89477459.jpg?w=50&ulb=true&ssl=1)

![Best Choice Ever (2024) [Chinese] (TV series)](https://www.memesng.com/r/storage.waploaded.com/images/3a6ca7b9f3b604be5a3d8ec7909d63a6.jpg?w=50&ulb=true&ssl=1)

![Live Surgery Room (2024) [Chinese] (TV series)](https://www.memesng.com/r/storage.waploaded.com/images/2cb04ff4b825ec2f4128646f44ae0035.jpg?w=50&ulb=true&ssl=1)

{{comment.anon_name ?? comment.full_name}}

{{timeAgo(comment.date_added)}}

{{comment.body}}

{{subComment.anon_name ?? subComment.full_name}}

{{timeAgo(subComment.date_added)}}

{{subComment.body}}